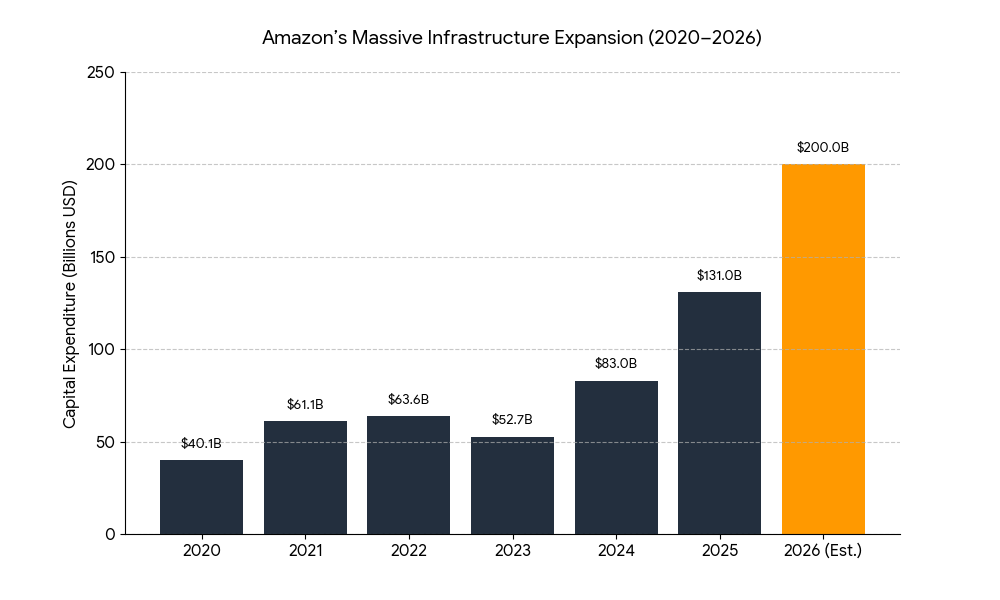

Amazon is placing a massive bet on its future. In its latest financial update, the company confirmed it will spend $200 billion in 2026. This is more than a simple budget increase. It marks a major shift in how the company uses its cash as it moves from shipping packages to building the heavy hardware that runs modern computing.

The stock market reacted with immediate skepticism. Amazon shares fell by 10% as the news broke, which cut about $250 billion from its total market value.

The logic among investors is simple. $200 billion is an enormous amount of money to spend before seeing a clear profit. While Amazon reported record revenue of $213.4 billion this past quarter, the fear is that this spending will drain the company's savings. Shareholders are essentially asking if the return on this investment will ever actually justify the cost.

Amazon CEO Andy Jassy says the spending is necessary because they cannot keep up with demand. The money is being used to expand Amazon Web Services (AWS), which grew its revenue by 24% recently. This was its fastest growth in over three years.

It isn't just about buildings though. Amazon is now making its own AI chips and custom silicon, such as Trainium3, so it can stop buying expensive parts from other companies. They are also securing their own power sources. This includes deals like Project Spectrum to put data centers directly next to nuclear power plants. Amazon is trying to own every part of the chain, starting with the electricity and ending with the software.

This move by Amazon shows where the entire industry is headed. Google, Microsoft, and Meta are all on a similar path and are spending hundreds of billions combined. We are seeing a shift where the biggest names in tech behave more like power companies or industrial giants rather than software startups.

They are racing to build a global network of "compute" that they can rent out to everyone else. Amazon wants to be the landlord of this new digital world. They are betting that being the biggest player in the room is worth the $200 billion price tag today.

A New Utility If this works, Amazon becomes the backbone of the internet. Every new app or service would run on Amazon’s hardware, which creates a steady stream of rent payments for decades.

Efficient Logistics Some of this money goes toward smarter warehouse robots. This could make delivery even faster and help keep prices lower for customers by cutting the cost of moving goods.

Energy Demand These data centers need a massive amount of power. There is a risk that tech companies will compete with regular people for electricity. This could lead to higher bills for households and pushback from local governments.

The Overcapacity Risk If businesses eventually find cheaper or simpler ways to work without massive AI models, Amazon could be left with $200 billion worth of specialized hardware that nobody wants to use.

Why did Amazon shares drop by 10%?

Investors were spooked by the $200 billion spending forecast for 2026, which was much higher than expected. There are concerns that these massive infrastructure costs will hurt short-term profits.

What is the $200 billion being used for?

Most funds will expand AWS through data centers and specialized hardware like the Trainium3 chip. It also supports energy projects and the Project Kuiper satellite network.

How fast is Amazon’s cloud business growing?

AWS reported a 24% revenue increase this quarter, its strongest growth in 13 quarters. This is driven by high demand for AI workloads and traditional cloud services.

Is Amazon moving away from Nvidia chips?

Amazon is reducing reliance by investing in its own Trainium and Graviton chips. This strategy aims to lower costs for customers and improve long-term margins.

*This article was written by a human with the assistance of AI.

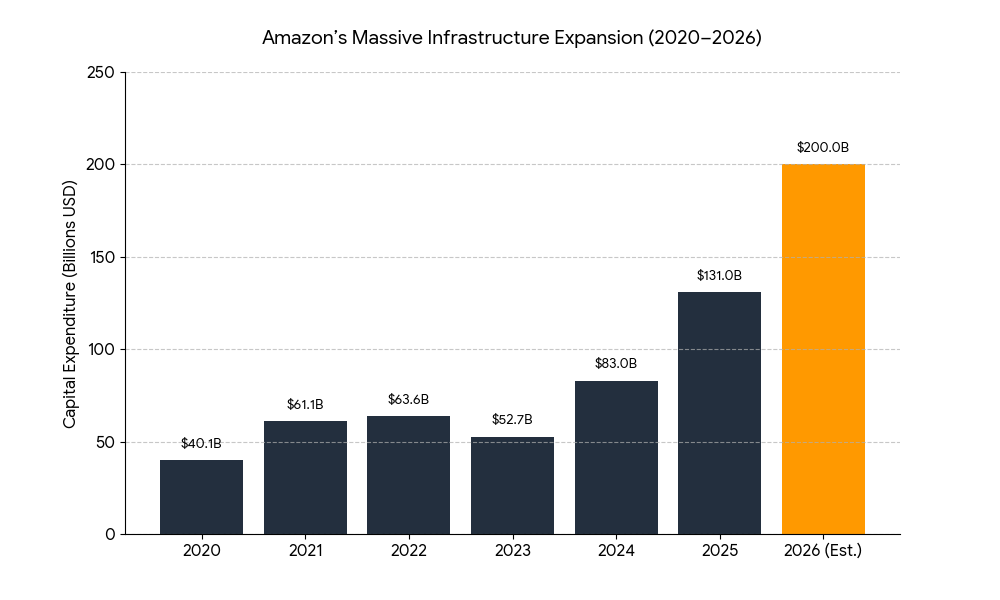

Amazon is placing a massive bet on its future. In its latest financial update, the company confirmed it will spend $200 billion in 2026. This is more than a simple budget increase. It marks a major shift in how the company uses its cash as it moves from shipping packages to building the heavy hardware that runs modern computing.

The stock market reacted with immediate skepticism. Amazon shares fell by 10% as the news broke, which cut about $250 billion from its total market value.

The logic among investors is simple. $200 billion is an enormous amount of money to spend before seeing a clear profit. While Amazon reported record revenue of $213.4 billion this past quarter, the fear is that this spending will drain the company's savings. Shareholders are essentially asking if the return on this investment will ever actually justify the cost.

Amazon CEO Andy Jassy says the spending is necessary because they cannot keep up with demand. The money is being used to expand Amazon Web Services (AWS), which grew its revenue by 24% recently. This was its fastest growth in over three years.

It isn't just about buildings though. Amazon is now making its own AI chips and custom silicon, such as Trainium3, so it can stop buying expensive parts from other companies. They are also securing their own power sources. This includes deals like Project Spectrum to put data centers directly next to nuclear power plants. Amazon is trying to own every part of the chain, starting with the electricity and ending with the software.

This move by Amazon shows where the entire industry is headed. Google, Microsoft, and Meta are all on a similar path and are spending hundreds of billions combined. We are seeing a shift where the biggest names in tech behave more like power companies or industrial giants rather than software startups.

They are racing to build a global network of "compute" that they can rent out to everyone else. Amazon wants to be the landlord of this new digital world. They are betting that being the biggest player in the room is worth the $200 billion price tag today.

A New Utility If this works, Amazon becomes the backbone of the internet. Every new app or service would run on Amazon’s hardware, which creates a steady stream of rent payments for decades.

Efficient Logistics Some of this money goes toward smarter warehouse robots. This could make delivery even faster and help keep prices lower for customers by cutting the cost of moving goods.

Energy Demand These data centers need a massive amount of power. There is a risk that tech companies will compete with regular people for electricity. This could lead to higher bills for households and pushback from local governments.

The Overcapacity Risk If businesses eventually find cheaper or simpler ways to work without massive AI models, Amazon could be left with $200 billion worth of specialized hardware that nobody wants to use.

Why did Amazon shares drop by 10%?

Investors were spooked by the $200 billion spending forecast for 2026, which was much higher than expected. There are concerns that these massive infrastructure costs will hurt short-term profits.

What is the $200 billion being used for?

Most funds will expand AWS through data centers and specialized hardware like the Trainium3 chip. It also supports energy projects and the Project Kuiper satellite network.

How fast is Amazon’s cloud business growing?

AWS reported a 24% revenue increase this quarter, its strongest growth in 13 quarters. This is driven by high demand for AI workloads and traditional cloud services.

Is Amazon moving away from Nvidia chips?

Amazon is reducing reliance by investing in its own Trainium and Graviton chips. This strategy aims to lower costs for customers and improve long-term margins.

*This article was written by a human with the assistance of AI.